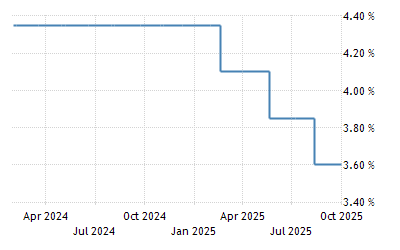

RBA interest rate

The cash rates very important because it influences the cost of peoples mortgages the rate of return they get on their savings. Prior to December 2007 media releases were issued only when the cash rate target was changed.

Ocizt59r Ylhbm

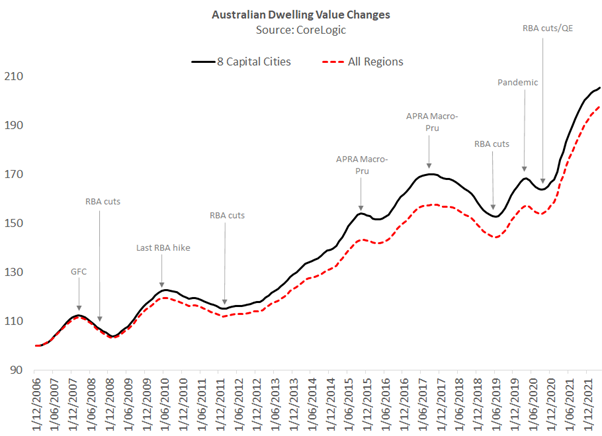

Prices went up 25 per cent over the past two years.

. If the asset price increases to 110000 then Janes own money after paying back the loan has doubled to 20000 ignoring interest costs. Heres a look at four common ones. RBA hiked the Cash Rate Target by 25bps to 260 exp.

About 298bn worth of fixed rate mortgages will expire by the end of. The board noted rates had already risen by 250 basis points since May and much of that had yet to feed through into mortgage payments. So the community has a lot of interest in those decisions.

The RBA cash rate affects the interest rate banks charge their customers as well as the rates of interest paid on savings accounts and term deposits. It influences the exchange rate and the value of peoples assets. Cash Rate Target.

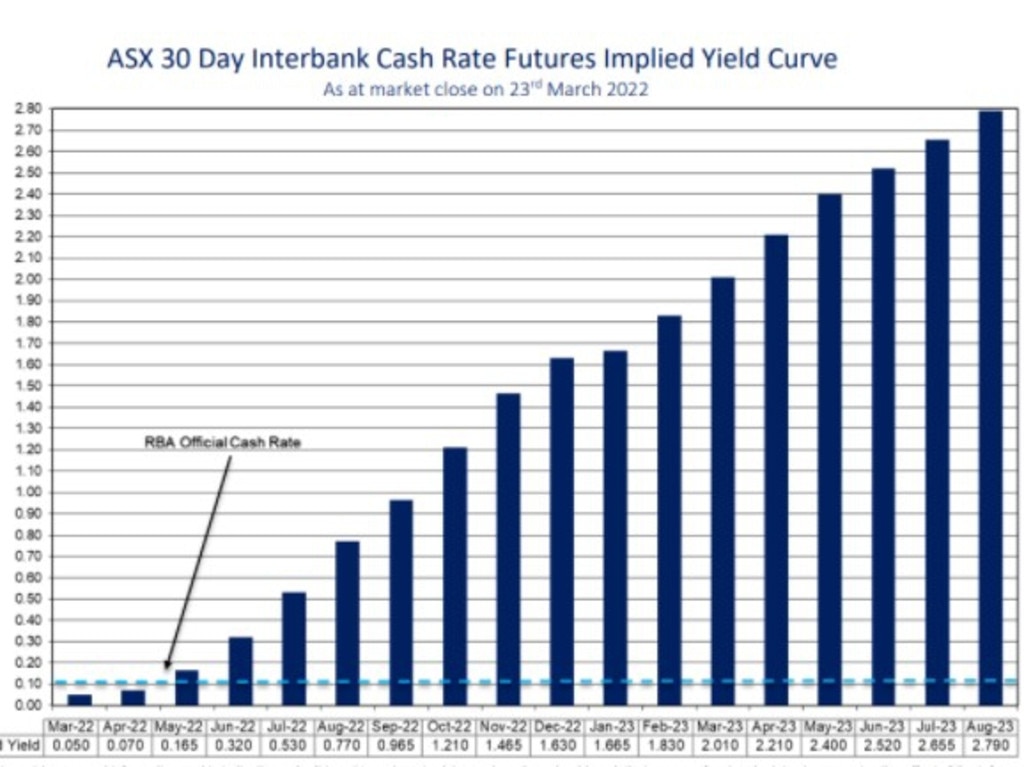

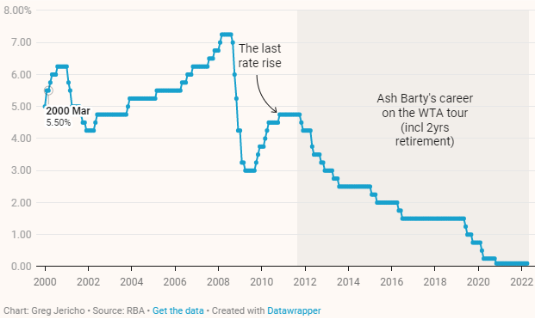

The neutral rate is a real interest rate. At the time the cash rate target was 01 per cent and it is now 235 per cent and Mr Lowe plans to raise the rate even more in coming months. 1197 in interest costs compared to a 16 APR which was the average interest rate at the beginning of 2022.

AAPGetty The Reserve Bank of Australia RBA is tipped to hike the cash rate again tomorrow by 050 per cent taking it to 285 per cent the highest level since April 2013. The Reserve Bank of Australia RBA opted to slow the pace of interest-rate hikes citing growing risks to households minutes of the central banks October meeting showed. RBA stated that the Board is committed to returning inflation to the 23 range over time and expects to increase interest rates further over the period ahead.

Eleven times a year the Reserve Bank of Australia RBA meets to decide whether the cash rate should go up down or remain the same a decision which affects millions of Australians. The Reserve Bank also produces and distributes Australias banknotes. The RBA is expected to deliver another double-whammy interest rate hike tomorrow.

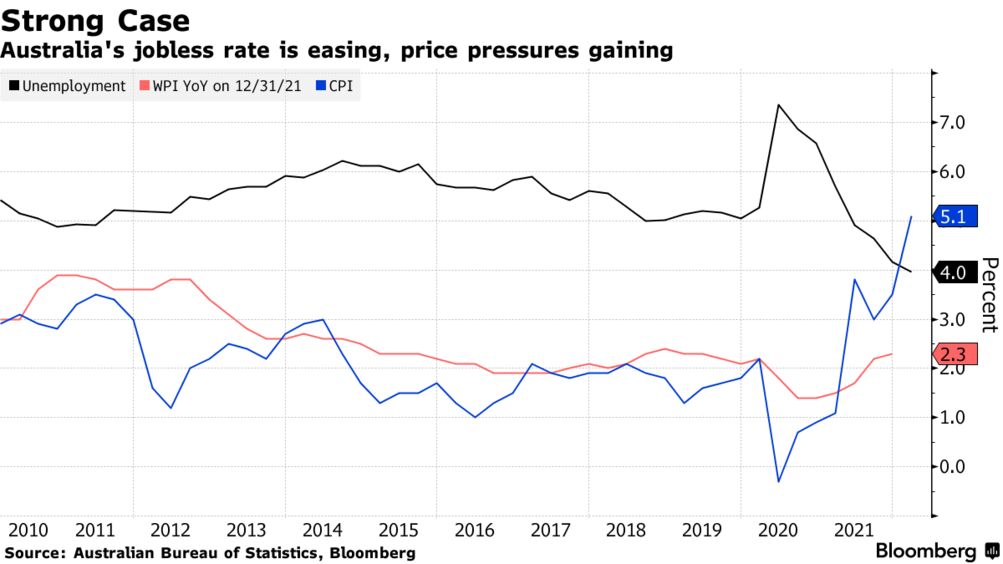

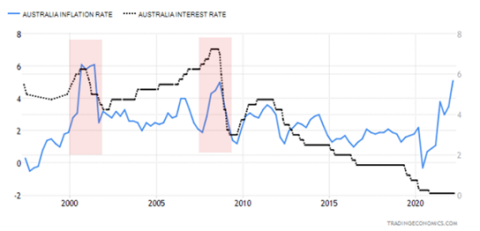

NAB was the first of the big four banks to pass on the October rate hike in full. The RBA has been lifting interest rates to slow inflation which at a monthly level has reached its fastest pace since the 1990-91 recession. Then in May this year disaster struck when the RBA announced the first official interest rate hike since 2010 lifting the cash rate by 25 basis points to 035 per cent.

Lending to Business Business Finance Outstanding by Business Size and Interest Rate Type D14 Data Lending to Business Business Finance Outstanding by Business Size and Industry D141. The Reserve Bank of Australia has hiked interest rates for the sixth month in a row but by only half the size of the previous five raises lifting the cash rate by 25 basis points to 26 per cent. The RBAs main rate is 26.

RBA lifts cash rate by 025 of a percentage point to nine-year high of 285pc NAB first to pass on as it happened. A Includes loans at variable and fixed interest rates Sources. File image of a NAB branch.

In seasonally adjusted terms this growth was primarily driven by increases in wages for the private sector which grew at twice the rate of wages in the public sector 12 percent compared to 0. The tightening had also hit home. 2017 The Neutral Interest Rate RBA Bulletin September pp 918.

More tightening may be ahead but it may come in more measured increments over the next. Tuesdays interest rate hike is the sixth in as many months. A media release is issued at 230 pm after each Reserve Bank Board meeting with any change in the cash rate target taking effect the following day.

Interest Rates Too much. Imagine that Jane buys an asset for 100000 using 10000 of her own money and 90 000 of borrowed money. Monetary policy decisions involve setting a target for the cash rate.

Economic theory holds that it is real inflation-adjusted interest rates that matter for peoples saving and investment decisions. By Shiloh Payne and business reporter Gareth Hutchens. The Reserve Bank of Australia RBA has chosen to lift the interest rate by just 25 basis points the same rise as in October for the seventh increase in as many months.

The average Aussie familys home buying budget has shrunk by around 214600 thanks to the Reserve Bank of Australias RBA rate hikes according to new data. The RBA Rate Indicator shows market expectations of a change in the Official Cash Rate OCR set by the Reserve Bank of Australia. The Federal Reserve raised the target range for the federal funds rate by 75bps to 375-4 during its November 2022 meeting marking a sixth consecutive rate hike and the fourth straight three.

ANZ increased its variable interest rates by the full 025 per cent for borrowers and increased the rate on some of its savings accounts as did the Commonwealth Bank. Bank of Canada Interest Rate Expectations October 13 2022 Table 1. The Reserve Bank of Australia RBA interest rate decision may do little to shore up AUDUSD as the central bank shows little interest in carrying out a restrictive policy.

RBA Rate Tracker Order types ABOUT US. Trade our derivatives market. Taking the annual rate up to 54 per cent.

RBA For more details see Statistical Table F6 Housing Lending Rates and Statistical Table F7 Business Lending Rates. Interest rate updates. See also Holston K T Laubach and JC Williams 2016 Measuring the Natural Rate of.

RBA tipped to confirm seventh consecutive rate rise as mortgage cliff looms.

Goceonepbrz2pm

How Rba Will Raise Interest Rates What It Means For The Housing Market News Com Au Australia S Leading News Site

Aud Jpy Nzd Jpy Weekly Forex Outlook Australian Economic Indicators Indicate Reacceleration Of Rba Interest Rate

Interest Rates Chart Pack Rba

Rba Cash Rate Raised To 2 60 Smartmove

7h0yoy9zal A8m

Rba Considered Three Options For Size Of Interest Rate Hike Bloomberg

Wiping 1 5 Trillion Off House Prices Will Force Rba To Pause After 100 150 Basis Points Of Rate Hikes Christopher Joye Livewire

Australia S Rba Raises Interest Rates For The Straight Month

Cfdgwwvckpfx5m

Zyw2aawqknxnam

S Bithzrxojqmm

Rba Meeting Preview Why Interest Rate May Go Up This Week And When Will Inflation Peak Ig Australia

Rba Official Cash Rate Ocr Aktuelle Und Historische Zinsen Der Australischen Zentralbank

Rba 2022 Interest Rate Forecast Bad News For Property Market

Rba Raises Interest Rates And More Us Earnings Due Tixee

Rba Hikes Interest Rate Up By 50 Basis Points To 1 35 Per Cent Sky News Australia